Insights and resources

Read our expert insights and resources to learn more about automating asset management processes, data management and how we’re supporting financial services transformation.

From data processing to intelligent operation: Unlocking value with AI and automation

Xceptor at SIFMA Ops 2025: Uncover key insights from partner workshop with OnCorps AI on AI and automation adoption.

The Automation Playbook for Technology Leaders in Capital Markets

This eBook provides a practical framework to help capital markets firms implement automation and AI effectively.

Unlock Digital Transformation in Capital Markets with Data Automation

Discover the case for digital transformation in capital markets. Learn how to improve efficiency, reduce risk, and future-proof your operations today.

Operational efficiency is driving digital transformation in capital markets

New research by Crisil Coalition Greenwich reveals that operational efficiency is a crucial driver for digital transformation in capital markets.

Webinar: The Data Imperative in Capital Markets Success

Explore how operational efficiency is driving digital transformation in this discussion with Crisil Coalition Greenwich.

The path to intelligent data automation within capital markets operations

Discover the role of intelligent data automation (IDA) in capital markets and how these platforms have evolved.

InvestOps Connect Europe 2025: Scaling Smarter, Not Harder

Xceptor at InvestOps Connect Europe 2025: Explore the highlights, industry challenges, and technology’s role in operations.

Leveraging Gen AI for Growth

Find out how Danske Bank and Xceptor are leveraging Gen AI to fuel growth strategies.

Expanded Collaboration with Danske Bank

Learn how Xceptor delivers enhanced client services and operational efficiency, expanding from tax to reconciliations.

Xceptor Data Automation Platform Overview

Discover how Xceptor's purpose-built automation platform tackles the biggest operational challenges in capital markets.

Xceptor Document Intelligence explained

Use AI to extract key information from documents - whatever the format (structured, unstructured, semi-structured) - with speed and accuracy.

GDS Banking Innovation Summit 2025

Missed us at the GDS Banking Innovation Summit on May 21-22, 2025 in Tampa, Florida? Schedule some time with us!

InvestOps Europe Connect 2025

Missed us at InvestOps Europe Connect 2025 on May 22-23 in London? Schedule some time with us to learn about Xceptor's data automation platform.

Xceptor Tax Document Intelligence

Xceptor’s Document Intelligence transforms how financial institutions process tax documentation.

SIFMA Ops 2025

Did you miss us at SIFMA Ops in Orlando? You can still book a meeting with us to learn more about Xceptor's Data Automation Platform.

How technology teams can leverage automation for operational resilience

Discover how technology teams in capital markets can leverage data and workflow automation to enhance operational resilience.

16th Annual Operational and Back Office Excellence in Banking Summit

Missed us at the 16th Annual Operational and Back Office Excellence in Banking Summit? There's still time to book a meeting with our team to learn abo...

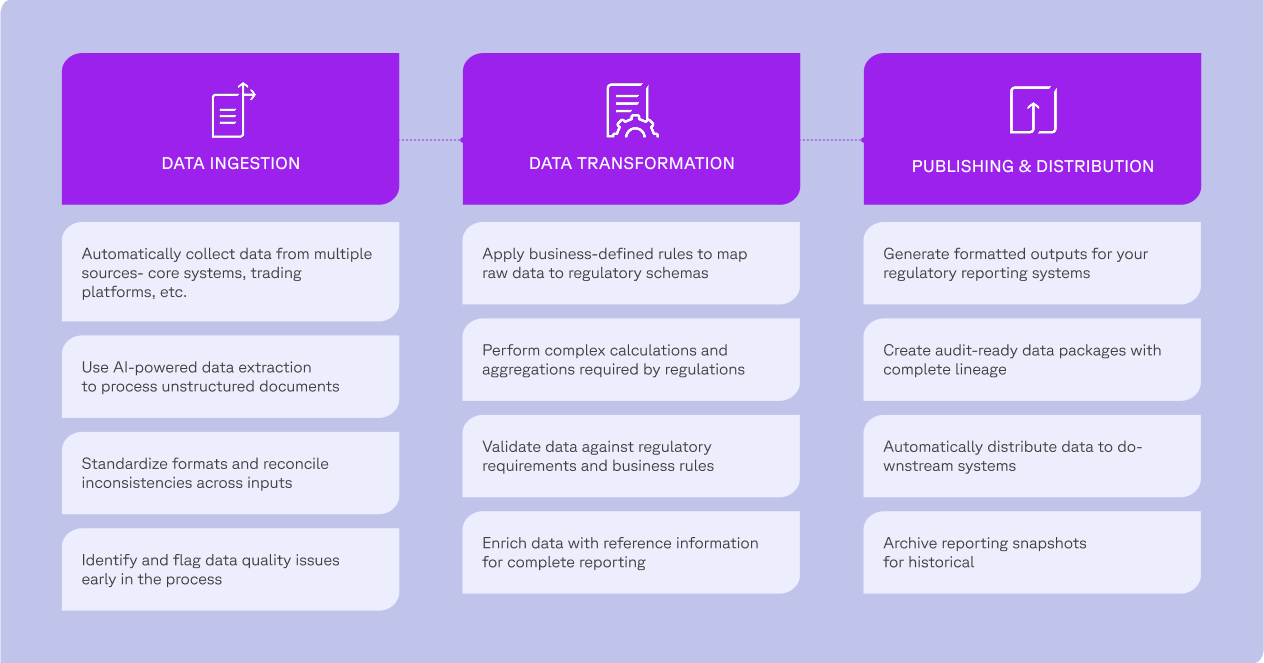

Regulatory Reporting

Take control of your regulatory reporting process and adapt quickly to changing requirements

Xceptor Document Intelligence

Streamline document processing with Xceptor's AI automation

GAIM Ops Cayman 2025

Did you miss us at GAIM Ops Cayman 2025? There's still time to schedule a meeting with our team to learn about Xceptor's data automation platform.

How Capital Markets firms transformed operational efficiency with process automation

Discover how capital markets firms are transforming operational efficiency with process automation. Learn from industry experts and Xceptor clients ab...

As T+1 approaches in the UK, how to prepare for compliance today

As Europe’s capital markets industry braces for the transition to T+1 settlement cycles, the UK Accelerated Settlement Taskforce (AST) has unveiled it...

Optimize Loan Notice Management with Xceptor

Our latest video showcases the power of AI-driven data extraction and intelligent workflow automation, enabling your operations team to handle peak vo...

InvestOps USA 2025

Missed us at InvestOps USA? Book a meeting and learn more about the Xceptor Data Automation Platform.

AI, Cloud, and Automation: Xceptor's Roadmap for Capital Markets Operations in 2025

Discover Xceptor's 2025 product roadmap that puts practical AI applications and cloud solutions at the centre of what we do for capital markets operat...

Unlocking business value through streamlined reconciliations

Read our e-book to understand how you can overcome traditional challenges with listed or exchange-traded derivatives.

BVI Fund Operations 2025

Did you miss Xceptor at Stand 32? You can still book a meeting and discover how AI and data automation are set to reshape fund operations.

Xceptor for Fund Administrators

Transform fund administration operations with data automation

OPEX World Summit 2025

Did you miss meeting Xceptor at Booth #33? Get in touch to discover how our AI-powered automation drives innovation, improves decision-making, and enh...

Rethinking the Loan Notice process: The need for AI-powered Loan Notice management

Explore how the private credit market's growth impacts loan operations teams and how loan notice management alleviates these challenges.

The power of client onboarding

Discover how automation transforms client onboarding in financial services, reducing time and enhancing client experience.

Automate Asset Management to drive Operations Efficiency: tips from top buy-side firms

Every buy-side firm is looking for ways to reduce costs and streamline operations. Here are some insights from successful automation initiatives.

Loan notice management

Overcome notice volume and complexity by combining automation with AI.

What is EU FASTER?

Paul Duffy explains what EU FASTER is and how the process involved will work.

Transforming Capital Markets

Here are a few of the key trends we expect to see more of in AI and Data Automation in 2025

Client lifecycle management

Boost efficiency with end-to-end client lifecycle automation.

Modernizing fund services

A webinar discussion tackling the challenges faced in the fund administration sector that hinder efficiency and compliance.

Get ahead of FASTER: a guide to tax digitization

Explore the barriers organizations must overcome to prepare for FASTER and learn how data automation can help you succeed amid the transition to digit...

Future-proof your tax operations

Digitizing tax processing is no longer a nice to have. Discover the essential steps to digitize your tax processes in our webinar with KPMG.

Processing unstructured tax documents

This short demo will show you how to process unstructured documents using Xceptor Tax Intelligence.

Overcoming data quality challenges with AI and augmented data quality

Learn how augmented data quality (ADQ) enhances data accuracy, risk management, and compliance, while reducing manual efforts and costs.

Best practices for buy-side data management across structured and unstructured data

This webinar reviews the challenges of buy-side data management across structured and unstructured data, and approaches to improvement including data ...

No automation, no T+1

The fundamental lesson from North America for Europe and Asia

How AI transforms unstructured document processing

Discover how AI is revolutionizing unstructured document processing and transforming your business operations.

How did the transition to T+1 really go?

The ValueExchange is bringing together experts from Citi, Delta Capita, FIS Global, and Xceptor for a webinar to discuss how firms are navigating this...

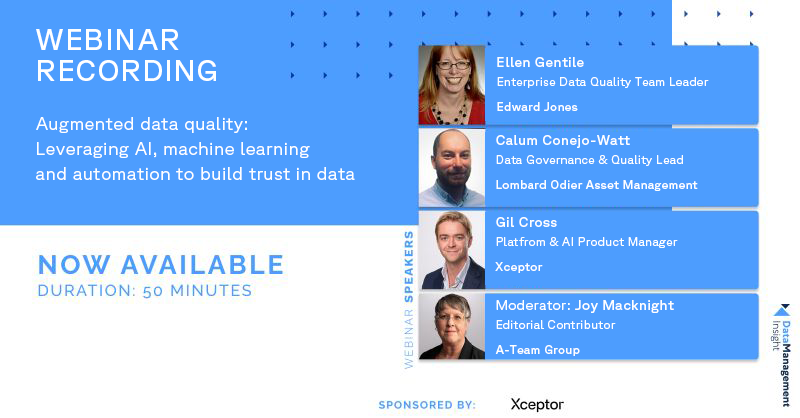

Augmented data quality: Leveraging AI, machine learning and automation to build trust in your d...

Listen now to our webinar with A-Team Group discussing augmented data quality and how it is leveraging data, artificial intelligence, machine learning...

LSTA Annual Conference 2024

Did you miss meeting Xceptor at booth #16? Get in touch to discover how our AI-powered automation can enhance your credit and loan lifecycle managemen...

SIFMA Ops 2024

Did you miss meeting with Xceptor at booth #412? Get in touch to discover how our data automation can enhance your back-office operations.

Streamlining fund administration processes for Catalyst

Learn how the team at Catalyst reduced daily reconciliation time by 50+%.

The operations revolution continues – 4 key takeaways from FIA IDX

Here are our four takeaways, and a welcome update, that we took from the 3-day derivatives conference.

FIA IDX 2024

Did you miss meeting with Xceptor at FIA IDX? Why not book a meeting and learn more about how we are revolutionizing data automation.

How financial services firms are using generative AI

Read on to learn about the rate of adoption of GenAI in financial services, the most common use cases and tips for your organization to get started.

Xceptor wins 'Most Innovative Data-Driven Transformation Project' at the A-Team Innovation Awar...

We're excited to share our story behind the award showcasing our commitment to revolutionizing data management and processing.

Complexity and technology in the rapidly expanding loan market

One key takeaway from LSTA is that the market is being propelled to accept the need for increased digital transformation and data-centric processes.

Beyond automation

Xceptor and AI's impact on Account Onboarding, Confirmation Matching and Tax Management

Key takeaways from InvestOps 2024

Operational efficiencies are the top strategic priority for firms in 2024 - read our key takeaways from InvestOps 2024.

Leveraging Gen AI and Document Intelligence in Financial Services Operations

In this session with Coalition Greenwich we discussed the immense potential of these technologies, particularly for operations teams within financial ...

LSTA Ops 2024

Did you miss us at LSTA Ops? Book a meeting and learn more about AI-powered automation for credit and loan lifecycle management.

Webinar Panel: Women's Impact in Technology within Financial Services

In honor of International Women's Month, we invite you to watch our special panel discussion focused on Women's Impact in Technology within Financial ...

Glossary of terms

Explore complex topics with ease using our glossary. We've gathered essential terms and clear definitions to simplify your understanding of diverse su...

InvestOps USA 2024?

Missed us at InvestOps? Book a meeting and learn more about the Xceptor Data Automation Platform.

Generative AI in financial services: an opportunity for operations

Generative AI and document intelligence offer immense potential for financial services companies – most notably for operations teams.

Revolutionizing energy markets: the power of automation

Energy market participants must accelerate their use of automation and technology to meet the challenges of a growing, more complex trading environmen...

T+1 in the UK: ignore the clock

Now we know - T+1 is happening. What’s less clear, and where debate is raging, is whether the UK should align more closely with the US and implement ...

4 universal data challenges for Capital Markets (and how data automation can help)

Our cars can park themselves when we arrive at the office and ChatGPT can write emails for us - but many financial firms still receive faxes daily.

Interconnected markets: the imperative for data automation in 2024

Financial markets are interconnected, complex and filled with risk. Can data automation help them achieve end-to-end processing and interoperability ...

Data automation in 2024: 6 stats to know

As 2024 approaches, we wanted to understand the state of data automation in middle and back offices. Here are some interesting statistics we uncovered...

Navigating regulatory change and market dynamics in 2024 - the power of technology and AI

As 2023 draws to a close, we look towards a new year that will continue the transformation of financial services, driven by technological innovation a...

Advice for buyers from Deep Analysis

Global advisory firm Deep Analysis has spotlighted Xceptor in their latest vendor vignette.

Xceptor wins best client onboarding solution at Data Management Insight Awards Europe 2023

According to McKinsey, onboarding is a great opportunity for financial institutions to differentiate themselves, win corporate customers, increase eff...

Clarity needed on FASTER initiative

EU moves to simplify withholding tax must address the practical realities of dealing with 27 different authorities

Schroders' implementation of intelligent data automation

Learn how Xceptor helped Schroders streamline their operations, achieve high data accuracy, and robust governance.

Xceptor platform demo

This short demo is designed to provide you with a taster of the Xceptor platform capabilities.

Unleashing the power of automation: redefining Capital Markets with data

Without data automation, Capital Markets firms will continue to deal with slow, inefficient processes and the never-ending remediation of errors due t...

Surviving the T+1 deadline: a guide to efficient data and automation

This session will delve into strategies for improving trade lifecycle efficiency, managing vast data volumes, and implementing process automation effe...

Data automation is the only solution to workflow efficiency

Coalition Greenwich research underscores the urgency for tech and automation in capital markets due to the 2024 deadline for T+1 settlement.

Reflections on Sibos 2023

As the dust settles on Sibos 2023, I look back at the deliberations including the prospect of a frictionless T+1 settlement ecosystem, the role of AI ...

Agile GTR Recs

We are removing the need for mundane manual work while boosting high-value activities.

Tax Document Management and Tax Relief at Source

Watch our video for a high level overview and demonstration of two modules from the Tax Processing Solution

Take control of legacy system reconciliations

Reconciliation is an often overlooked and undervalued activity within financial services.

Automating daily trading positions

Learn how our client reduced their daily trading positions tracking from three hours to less than five minutes.

Xceptor Tax Platform modules

This short video is designed to introduce you to Xceptor Tax Processing and the seven modules that make up the product.

AI-powered email classification

How a leading bank successfully used natural language processing to automate its email review process.

Gathering for collaborative finance in Toronto at Sibos 2023

Funds Europe has sought insights from some of the speakers at Sibos 2023 including our very own John Bevil.

Streamlining the onboarding of complex funds

Discover how a leading bank transformed its complicated fund onboarding process from an expensive burden to a significant business growth opportunity ...

A strategic approach to tactical reconciliations

There will be times when business users require a tactical, efficient, and convenient reconciliation tool to solve a business need. EUCs respond quick...

The journey to T+1 settlement

John Bevil shares his thoughts on how technology can help businesses achieve their T+1 targets with A-Team Insight.

Sibos - Toronto - September 2023

Did you miss us at Sibos? Why not book a meeting with us to find out how Xceptor can automate your back office processes.

Time is of the essence for fund administrators as T+1 is rolled out around the world

We teamed up with Firstsource to launch a solution tailored specifically for fund admins who are facing the realities of T+1.

Problems remain around T+1 implementation

There are "no easy fixes" for many issues around T+1, according to speakers at Xceptor's 20th anniversary celebration event.

What is an automation center of excellence?

Learn how to unlock your potential with an Xceptor Center of Excellence.

Data management from multiple sources

Find out how a leading investment bank eliminated keying errors, reduced costs and established an audit trail to effectively manage its data.

Removing the pain from tax reclaim

The automated capture, production and management of tax reclaims have transformed the tax reclaim process from income payment to credit of reclaims.

Automating the trade confirmation process

How a global bank's successful, rapid automation of its trade confirmations process led to further rollout to another division.

Prioritizing tax relief at source

Why you should prioritize providing a withholding tax relief at source service to your customers.

Xceptor's tax processing demo

This short demo is designed to provide an introduction to the Xceptor tax processing capabilities.

How to remediate your EUCs at scale

The webinar will discuss an approach to systematically and efficiently remediate EUCs, also known as EUD or EUDA, at scale while continuing to remain ...

Accelerate your reconciliations process

Find out how Xceptor accelerated a global investment bank’s reconciliations process by 50-75%.

Automating tax document management

In the first of our tax operations transformation series, we focus on automating tax documentation management to maximize tax relief at source.

Roadmap to T+1 infographic

From May 28, 2024, US Securities and Exchange Commission will move from a two-day settlement cycle (T+2) to a one-day settlement cycle (T+1).

Improve post-trade efficiency

Read the e-book to understand what financial institutions can do to prepare adequately for T+1.

Solving the challenge of bringing automation into financial services

Replacing legacy tech with new automated systems is no easy feat as various challenges arise.

Scaling payment fraud detection

How a global bank has successfully upped its game using AI to improve its fraud detection capabilities.

Automating client onboarding

How our client creates a positive customer experience through automated client onboarding.

Sifma operations conference

If you missed the lunch and learn session. Get in touch to learn more about the rise of APIs and the cloud - challenges and opportunities for shorter ...

Pitfalls of EUC reconciliation

EUCs are essential to your operations. But they represent risk. Learn how to identify and manage EUC risks across your business.

How to automate your 'tactical' reconciliations

Efficient and accurate reconciliations are critical for ensuring data consistency.

Are you in the T+1 slipstream?

Clients are reporting that T+1 is front and centre of their Spring workload and, for many, 2023 is the year of implementation and refinement.

Client outreach demo

This short demo will provide you with an introduction into the capabilities of Xceptor client outrech.

The future of withholding tax

We look at what the future might look like for Withholding Tax reclaims and how firms can flex to meet the demands of a modern WHT landscape.

Taking control of your reconciliations: data, aggregation, validation and enrichment

For any reconciliation to operate effectively it must be provided with readable and complete data.

Assess your T+1 readiness

Register for Xceptor and Wipro's webinar to assess your T+1 readiness and accelerate your automation strategy

Taking control of your Reconciliations: achieving greater efficiency

Reconciliation is essential to client satisfaction and data consistency, where multiple copies of the same trade data are maintained across firms.

T+1 gets closer every day. Are you ready?

We look at how firms can proactively ready themselves for the next transformational leap in processing and settlement cycles.

Navigating the intricate world of withholding tax

In the first instalment of our two-part on the world of withholding tax (WHT), we look at some of the key issues for WHT reclaims.

How T+1 will impact the confirmations process

For T+1 to make successful in-roads into a more robust and efficient post trade infrastructure, clear examination and a review of the confirmation pro...

Automating trade confirmations

How a leading global bank increased rates of straight through processing (STP) while reducing its risk and costs.

Xceptor Confirmations

Automate, consolidate, and control the issuance and matching of multi-asset confirmations in a single product.

Xceptor Reconciliations

Automate simple to complex reconciliations end-to-end, providing greater data transparency, accuracy, and control to Financial Institutions.

Xceptor Tax Processing

Helping Financial Intermediaries to stay on top of tax processes, handling data driven requirements for operational taxes more efficiently.

T+1: Swifter transaction management

Our latest T+1 blog addresses the need to automate transaction management to meet intra-day trade settlement.

Accelerated account opening in a T+1 world

A major impact to capital markets infrastructures by moving to T+1 is the reduced time for remediating sub-optimal account onboarding and account and ...

Streamline your tax operation like a pro

Is your tax processing getting out of hand?

Intelligent document processing

Take a closer look at how your organisation and your customers can benefit from end-to-end automation of semi-structured and unstructured documents.

Preparing for T+1: challenges and benefits of shortened settlement cycles

A global move towards T+1 settlements will likely create added benefits, if not examined at a strategic macro level, there could also be complications...

Predictions 2023: A year of evolution and adaptation

The competent extraction and transformation of data while offering end-to-end automation of complex processes will be imperative in 2023.

Client onboarding automation for financial institutions

Discover how you can reduce the time it takes to onboard a new client and provide a better experience.

Automating the post-trade process

With new industry operating initiatives coming to fruition, learn how Xceptor works to solve these challenges, and simplify multi-asset class post-tra...

Change on the horizon for EU Withholding Taxes

For too long, a fragmented European Withholding Tax landscape has stifled cross-border investments while resource-intensive reclaim procedures have le...

Managing client outreach in the financial industry

Register now to find out how to communicate to clients at scale and fast.

Unifying reconciliations with automation

Register for Xceptor's webinar to find out how you can automate simple to complex reconciliations in one single platform.

Employee trading compliance

Register for Xceptor's webinar to find out how you can automate the compliance process.

Driving experience @ Speed

Dan Reid joins Ramesh Revuru - VP & Global Head of Digital Engineering at LTI to take a deep dive into the world of low code / no code platforms

Harnessing the power of robotic process automation

How our client utilized RPAs to automation 6,000 back-office processes.

Celebrating women's achievements

This International Women’s Day we’re proud to join voices across the world in celebrating women’s achievements.

Interpreting data for the regulators in 2021

Could there be good news in the offing? In our latest podcast, PJ says the quest for digital standards that simplify complex regulatory reporting is o...

Our tax clients and tax community are our best sources of intel

For more than a decade, Xceptor has been fortunate to sit at the heart of an engaged and active tax community.

Xceptor swift support demo

SWIFT messages are pervasive in financial services processes and the ability to easily convert SWIFT messages into useful data inputs and get them out...

Reconciliations: Build the business case for change

Only a shift in mindset will bring about transformational change in reconciliations. Now is the time to make a difference to how the function operates...

Is reconciliation the problem or is it data control?

Capco's Jibs Ahmed threw down the gauntlet to Capital Markets firms – do data properly so that reconciliations don’t exist.

Trusted data: mirage or nirvana?

A c-suite perspective on what matters when it comes to data.

Bridging the gap

Dan Reid, CTO of Xceptor, shares his insight on the common ground between data engineers and business analysts

Put your data first

Andrew Kouloumbrides, shares why trusted data is essential to making better decisions. Data-driven and customer-centric decision support should be the...

Forrester Total Economic Impact of Xceptor

Forrester carried out a Total Economic Impact study to calculate the cost savings and business benefits of using Xceptor.

HFS hot vendors 2020

Download the exclusive HFS Hot Vendors report for more information on the vendors that are helping firms build tech stacks for the future.

HFS point of view

Read the HFS highlight to discover the benefits of an industry-specific approach.

HFS Blueprint for successful AI transformation

We examine how the financial services industry can adopt five transformation levers to get the most out of AI investments. Download the report and dis...

2020 predictions on regulation

It’s time for Regulatory 2.0 – major regulators and international bodies are starting to step back and review their regulations, asking – why did we d...

Opinion: Capital Markets and the Road to Intelligent Automation

Opinion piece by Xceptor CEO, Andrew Kouloumbrides: Many firms are underutilizing the full potential of automation technology. How can firms overcome ...

Adox data exception management

Download this exclusive Adox report commissioned by Xceptor - Analysing the impact of data exception management.

Using machine learning to augment automation

Push aside the AI hype and identify practical applications that deliver tangible returns. That's the mission for augment automation.

Driving digital transformation success through data

The main drivers for digital transformation programmes should be differentiation and customer value. With this approach, greater cost reduction is ac...

Celent digital transformation guide

The Celent digital transformation guide Capital Markets are reading - Digital starts with data.

Digital transformation: the new dawn belongs to data

Secure your own survival. Download our digital transformation report for financial institutions and protect your future.

5 ways to get ahead with buy side account opening

Now is the time to focus on the looming buy side account opening deluge. 2020 initial margin rules will make an already overburdened account opening f...

What is the real impact of data exceptions on regulatory reporting?

A recent Adox Research survey shows powerful stakeholders in compliance and other front-line functions, are targeting data exceptions as the missing l...

Ready to discover what Xceptor can do for you?

.png)

.png)

%20-%20Feb%202025.png)

.png)

.png)