As economic dynamics shift, geopolitical turbulence rises, and regulatory landscapes evolve, financial markets face ongoing pressure.

The upheaval is not confined to these arenas - technology teams are also grappling with the advent of generative AI disrupting their strategies, just as the industry adapts to the T+1 shift.

In response to this flux, middle and back offices are turning their attention toward data automation as a means to secure stability and promote growth.

As 2024 approaches, we wanted to understand the state of data automation in middle and back offices. Together with Coalition Greenwich, we surveyed dozens of senior capital markets leaders to learn: How many data sources are firms dealing with? Which asset classes cause the most data problems? What are the most pressing risks?

Here are some of the most interesting statistics we uncovered and what they reveal about the state of data automation today.

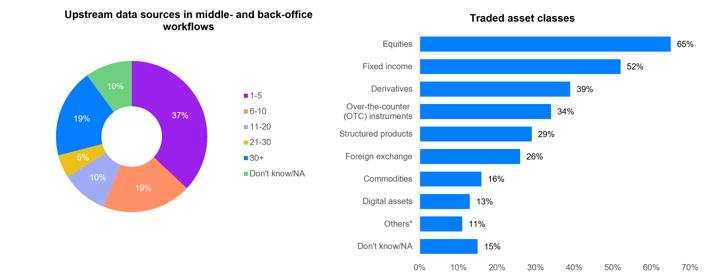

1. 34% of firms deal with 11+ upstream data sources

We found that a third of firms receive information from 11 or more trading venues, direct dealer connections, chats, phone calls, and other places. One in five firms has to handle more than 30 upstream data sources.

These results made it clear that "everything happens in the middle and back office," as Audrey Blater, senior analyst at Coalition Greenwich, puts it. "That’s a lot of information to be aggregating and consuming."

"Much of this increased complexity is a result of growth," Alexander Gent, buy-side lead at Xceptor, explains. "If you’re a successful company, your counterparties increase, your headcount increases, your number of portfolios increases… by default, there’s just more data to deal with."

For example, fixed income has been a very successful space over the past four years. As AUM grows, so does data complexity.

"You have to catch up quickly to be able to ingest those [sources] and map them to the appropriate business rules to ensure that you’re expediting the loan processing time," Alexander says.

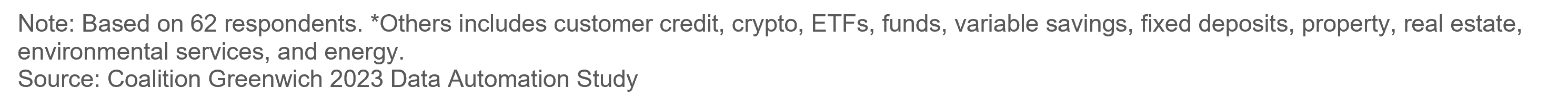

2. 90% of firms use up to 20 different workflow solutions

On top of growing upstream data, many firms are also dealing with a ballooning technology stack. When there’s more data to deal with, Alexander says, "you need more middle and back office solutions."

"This is preference for best of breed," Audrey says. Firms want to use the most appropriate tool for the job or asset class, even if that means adding complexity to their technology landscape.

Neither trend is likely to abate, so the challenge now is for firms to develop the capability to handle data from many parties and systems. "Everyone needs a data automation plan for ensuring idiosyncrasies between data transmission points and platforms are remedied," Alexander says.

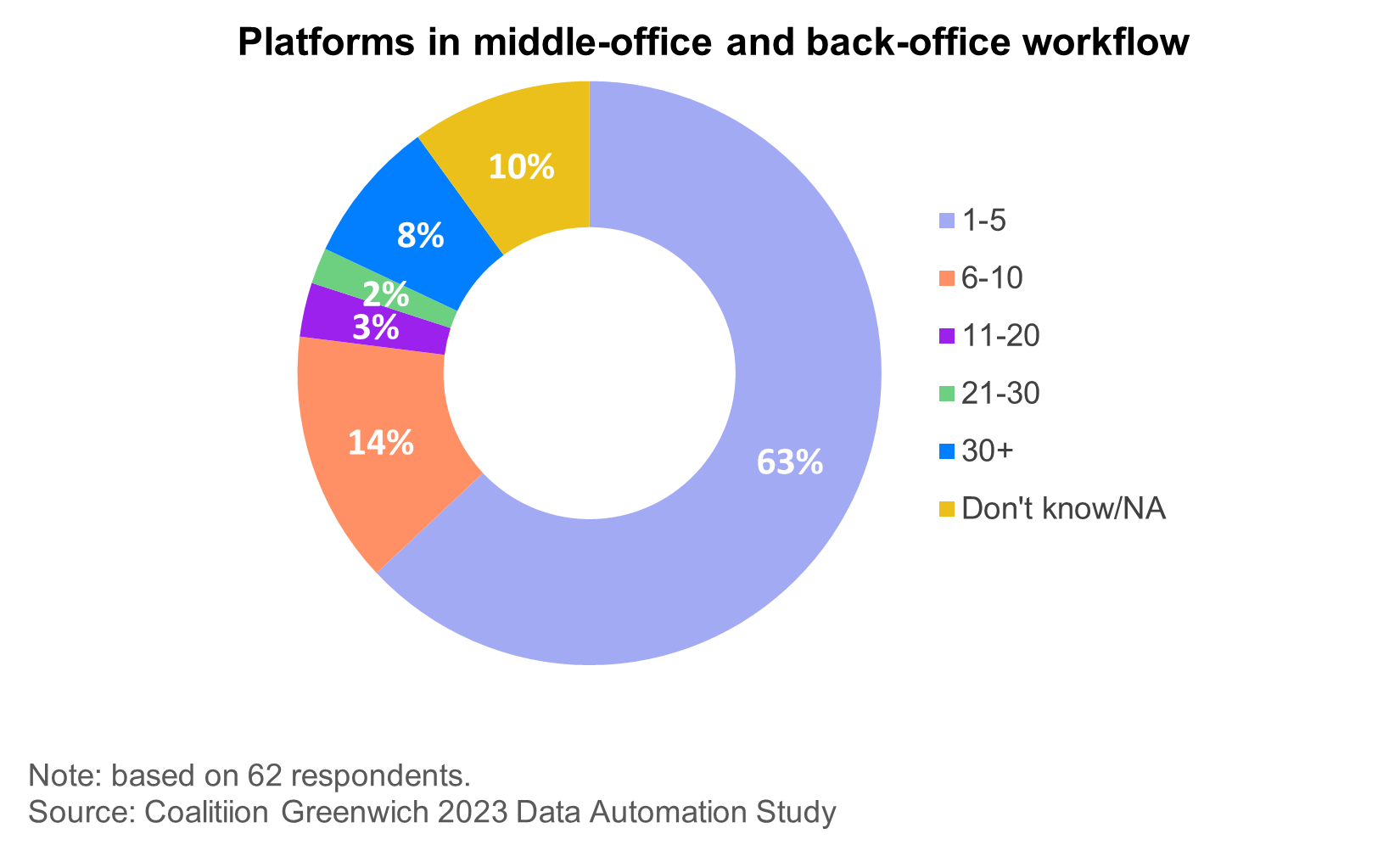

3. The industry's most pressing concern is missing settlement timelines

Operations teams know the risks of ever-growing data and technology landscapes. Our research shows that the industry views missed settlement timelines as the greatest risk stemming from a lack of automation - which is unsurprising as the T+1 deadline approaches.

"Exceptions, for instance, eat up a lot of time and effort, and they’re going to create barriers to T+1 settlement," Audrey says.

Alexander agrees, citing counterparty reconciliation as an example: "You’re dealing with your own system and the systems of the counterparties," he explains, adding that a lot of exceptions are driven by software errors, rather than the numbers themselves being wrong.

The more systems involved in reconciliation, the more opportunity for exceptions - and the longer your settlement time.

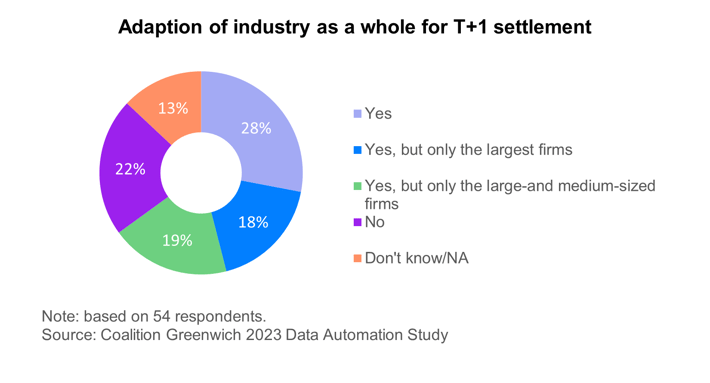

4. Nearly a quarter of the industry still doesn't think we're ready for T+1 settlement

Concern over missing settlement timelines is affecting how industry participants think about the upcoming T+1 deadline.

22% of respondents told us that they don’t think the industry is ready for T+1 settlement yet. Another 37% feel that only the largest or large- and medium-sized firms are ready.

"Like many of the other regulatory requirements that I’ve studied in my career," Audrey says, "it’s really that middle to small tail of firms that seem to be in this problematic area, where maybe they don’t have the staff or the know-how."

It seems that the remaining challenges stem from nuanced issues and certain asset classes that tend to be problematic.

One survey respondent cited the example of a European asset manager buying a US stock. Two-thirds of respondents feel that we’re ready to settle securities in a T+1 timeframe but are less certain when it comes to other asset classes.

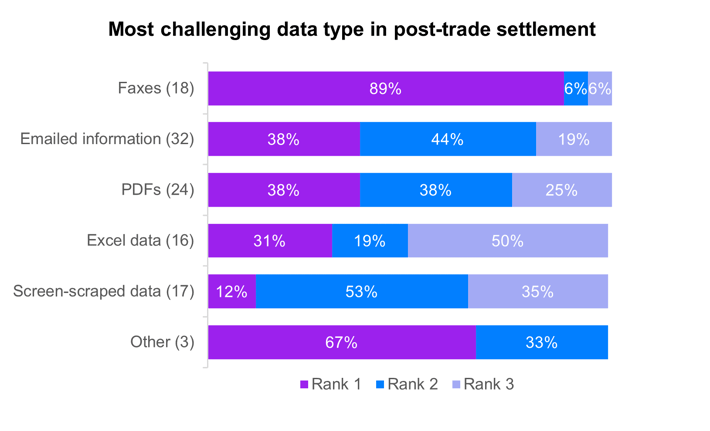

5. Unstructured data is still causing headaches across middle and back offices

Alexander shares a workflow that exemplifies the challenges posed by certain asset classes.

When a firm receives incoming margin calls, he explains, it has to "passively scan for unstructured data in emails or inbound data channels, in ways that will pick up messages in the body of an email or data that’s contained within the attachment of an email."

Emails aren’t the only form of unstructured data causing headaches in the middle and back office. "Asked to rank the most troublesome data transmission method to incorporate in post-trade settlement processes, respondents pointed to a variety of unstructured data sources.

While the fax machine may seem like a relic to some middle and back offices, others are still dealing with faxes on a regular basis - and they don’t like it. 89% of respondents who still use faxes call this decades-old technology their biggest pain point.

"[Faxes are] an industry precedent, especially in loans and CLOs," Alexander explains. Firms with loan-centric strategies are power users of Xceptor’s AI plugins for optical character recognition and natural language processing, which automatically extract information from faxes.

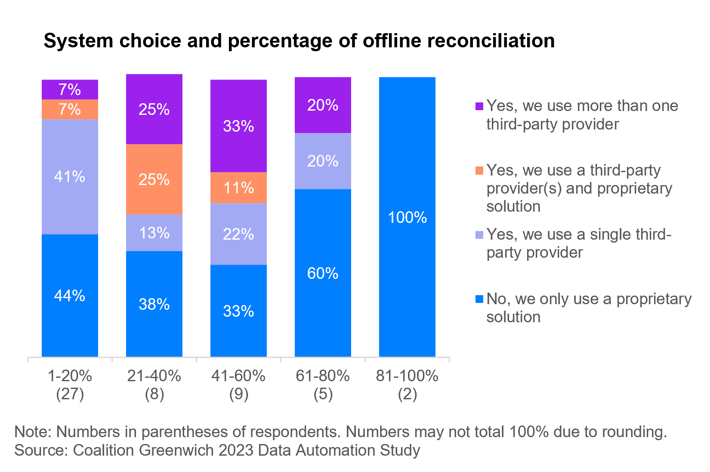

6. Technology choice is linked to reconciliation inefficiencies

One of the most intriguing things our study revealed was the connection between technology choice and offline reconciliations: the highest percentage of offline reconciliation is reported by firms using proprietary systems.

Alexander points out that firms use proprietary systems for a reason. "There are people who handle recs that are so complex that none of us can even begin to comprehend how esoteric they are," he says.

Alexander points out that firms use proprietary systems for a reason. "There are people who handle recs that are so complex that none of us can even begin to comprehend how esoteric they are," he says.

While out-of-the-box reconciliation platforms may address 75-90% of requirements, firms need custom software to deal with the long tail of false breaks and irregular workflows.

This is a prime opportunity for data automation: many of our clients in this situation have been able to replace their out-of-the-box platforms with Xceptor’s reconciliations solution.

The time is right to invest in data automation

The T+1 deadline has dominated conversations for years, but this moment is about more than just regulatory compliance.

"There’s a shift in market prescription of what a sophisticated tech stack looks like," Alexander explains, along with a strong appetite for hyper-automation and convenience. He’s watching Xceptor clients use data automation to generate alpha more quickly as they grow and expand.

Are you ready to transform your business processes and deliver trusted data? Get in touch to learn more about the power of data automation.

Report

Data automation: the workflow game-changer

The new Coalition Greenwich report underscores the urgency for tech and automation in capital markets due to the 2024 deadline for T+1 settlement.