Xceptor Tax

Digitize tax operations end-to-end by automating data-heavy processes.

Bolster regulatory compliance by streamlining processes for all key tax operations through a single, integrated, global tax platform.

Enhance efficiency in operational tax

Unified data management for all key tax operations. Automate workflows with complete auditability, using our no-code platform – eliminating manual, error-prone processes across the tax lifecycle, from account opening to reporting.

Tax document management

Tax document management

Relief at source

Relief at source

Enacting tax documentation on file, automating manual and time-consuming processes for applying relief at source.

Tax reclaims

Tax reclaims

End-to-end tax reclaim processing, from income payments to capturing reclaim opportunities to end payment reconciliation.

Electronic filing

Electronic filing

Output and transmit electronic tax data to a tax authority or another financial intermediary in the custody chain.

Rate determination

Rate determination

Supply tax information, calculations, documentation requirements, and other data to output channels and upstream systems.

Tax document intelligence

Tax document intelligence

Extract data from any tax document format, including handwritten, using AI. Automate validation and document matching through user-defined business rules, and manage the entire workflow - from ingestion to distribution - from a single UI.

US tax reporting

US tax reporting

Leverage data ingestion, reconciliation, and process automation to automate non-qualified intermediary reporting to the IRS.

Capital gains tax

Capital gains tax

Use rules to automatically capture liable transactions, calculate taxes to charge, and report to clients, tax authorities, or withholding agents.

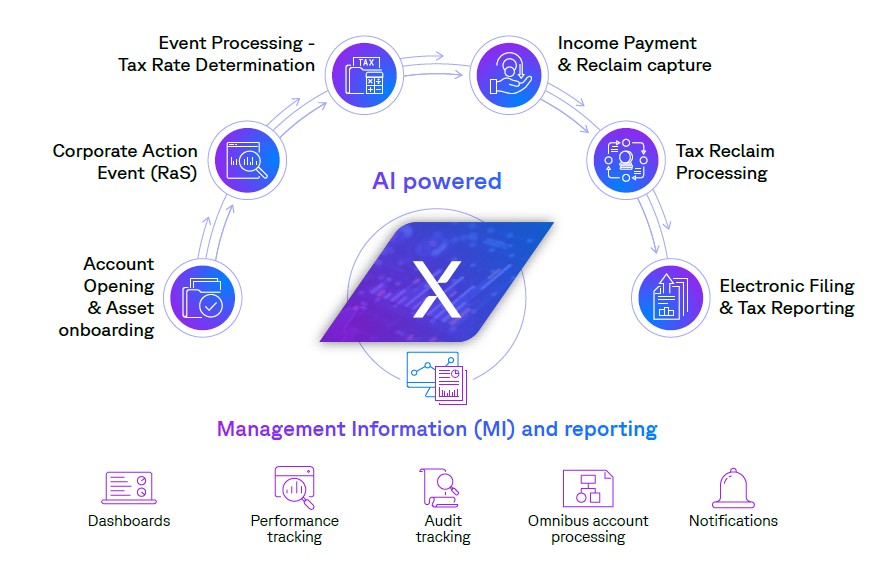

End-to-end automation for your tax processes

Account Opening & Asset onboarding

Xceptor automates the collection, validation, and storage of tax documentation during client onboarding. Our AI-powered document intelligence ensures all required forms are complete, accurate, and ready for future tax processing.

Corporate Action Event (Relief at Source)

When an income event occurs, Xceptor matches client holdings with valid documentation to apply reduced withholding tax rates upfront. Missing documents are chased automatically so clients can maximise relief opportunities before payment.

Event Processing - Tax Rate Determination

Xceptor calculates the correct tax rate using market rules, treaties, and client data, ensuring consistency across systems. We flag exceptions, reduce assumptions, and provide accurate tax instructions for downstream processing.

Income Payment & Reclaim Capture

Xceptor ensures validated tax rates flow seamlessly into payment processes, reducing errors and preserving full audit trails. Any unrelieved amounts are flagged for potential reclaim.

Tax Reclaim Processing

Xceptor detects reclaim opportunities, collects missing documentation, and generates complete reclaim packs automatically. We track the full lifecycle from submission to payment, integrating with agents and tax authorities along the way.

Electronic Filing & Tax Reporting

Xceptor prepares and submits tax reclaims and regulatory reports (including MiKaDiv) directly to tax authorities or through intermediaries. We validate data against strict market rules, manage UUIDs, and provide complete transparency from submission to final payment.

Leading custodians trust Xceptor

8 of the 10

global custodians use Xceptor

for tax processing

35,000+

different tax scenarios handled per custodian

Millions

of documents and transactions processed annually

Head of Product

Asia Pacific for Securities Services, Deutsche

which we will look to replicate in other markets, directly benefit our

foreign institutional clients such as global custodians, sovereign wealth funds, and asset managers by providing faster turnaround times and improved accuracy.

Leave manual processing behind and streamline your tax processes today.