Discover how technology teams in capital markets can leverage data and workflow automation to enhance operational resilience. Learn about the key capabilities...

HFS point of view

Finance leaders must adopt these five key AI transformation levers

The banking, financial services, and insurance (BFSI) industries must evolve their AI approach to survive the next wave of disruption

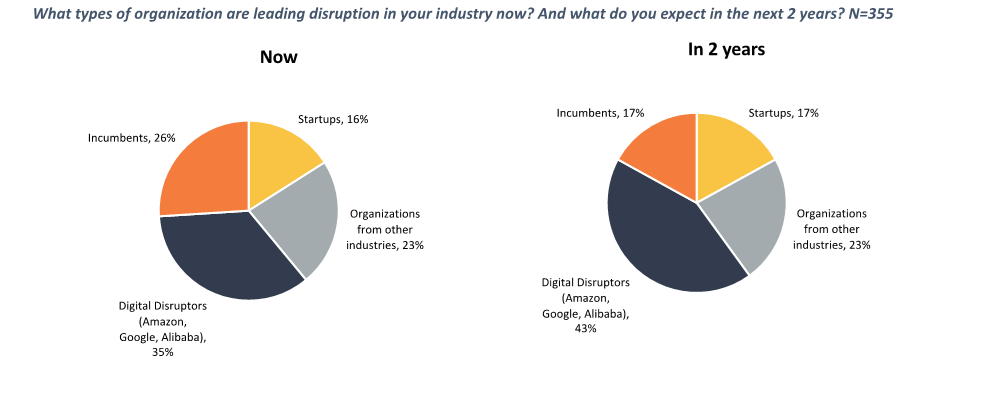

Modern finance is a complex and highly competitive industry. BFSI institutions are constantly under fire from rapidly changing customer demands and encroachment from digital disruptors—in the form of technology giants such as Apple and Facebook making inroads into financial services, and agile and niche disruptors carving out lucrative chunks of the market with innovative solutions and services. This sense of uncertainty and imminent disruption is captured in Exhibit 1, where BFS executives clearly outline a broad set of potential challengers to incumbents. With AI as a core building block to digital success in the modern market, we examine how successfully adopting the five transformation levers – People, Data, Domain Knowledge, Functional expertise, and operations – can help businesses drive real AI implementation success.

Exhibit 1: Disruption from incumbents declines as digital disruptors enter the market

Source: HFS Research supported by KPMG, “State of Operations and Outsourcing” 2019

Sample: G2000 Enterprise Leaders = 355

Historically, these executives would have focused on their direct industry competition, so keeping technology investment profiles broadly consistent and up to speed with peers was the core concern for both technology and business decision-makers. This broader uncertainty from incumbents is laid bare by a chief digital officer at a bank, who told us, “It’s unclear exactly when, how, and what disruption will occur. So, it’s a weird place to be in because you see these massive disrupters out there that are going to fundamentally change your business, and yet we still run a successful, profitable business today. This leads to very interesting dialogues because you can’t be blind to what’s happening.”

Now, as a more dynamic market shifts competitive landscapes into the unknown, BFSI executives must rethink how they implement and evolve new digital technologies. Their competitors are no longer leviathan banks with the same agility issues; they are nimbler start-ups or digital giants with cash to burn. The smart leaders in the BFSI market will rethink their relationship with digital technologies.

Partnering with Xceptor helped a multinational financial services firm transform business processes

Not all BFS leaders have adopted a wait-and-see policy as the market is disrupted around them. We spoke to a leading multinational financial services firm that had taken the initiative to partner with an intelligent automation provider, Xceptor, to tackle a series of domain-specific challenges. Foremost, the firm struggled with an industry-wide issue, that all financial operations were largely conducted through a series of complex and distributed spreadsheets. Working with Xceptor, the firm created a set of change leaders across financial operations to build transformational blueprints to help map out how business processes and functions can evolve. Now, over 350 employees globally work through the Xceptor platform. This drives a consistent approach for the management of financial operations –allowing for more flexibility and consistency than previous spreadsheet-based practices.

The transformation blueprint extended beyond the simple replacement of spreadsheets. According to the leadership team, the business used over 30 different solutions that pulled in data from separate sources. Using the Xceptor platform, the business replaced many of these solutions and implemented over 300 additional use cases within the solution. This process of consolidation solved one important challenge; the variations in financial reporting across the organization have decreased significantly thanks to the reporting capabilities built into the platform.

"We went from thirty separate systems to a single platform, enabling greater data transparency and accuracy."

Senior leader, major multinational bank

As the transformation process continued, the project team fostered more confidence as repeatable and robust intelligent automation solutions drove greater accuracy and transparency through the reporting function. This had the knock-on effect of driving up solution adoption and usage. Crucially, according to the financial services firm’s leadership, an important part of driving greater adoption and confidence in the solution is that for an average finance professional, the solution was relatively easy to learn. The Xceptor team’s deep domain knowledge further facilitated the ease of use; the team quickly and easily demystified the solution’s capabilities by aligning them with deep domain processes and the business vocabulary that employees used.

As any executive in a multinational business will argue, implementing any change can be challenging—particularly new technology suites that stray from traditional approaches. In this instance, the leadership team candidly advised that seeking help when you need it is often the biggest hurdle, particularly when updating technology suites is a continuous and often painful process for employees. However, reaching out to Xceptor to bring in deep domain expertise and a powerful set of solutions helped the firm transform its core business functions, boosting the consistency, accuracy, and transparency of vital data-intensive processes.

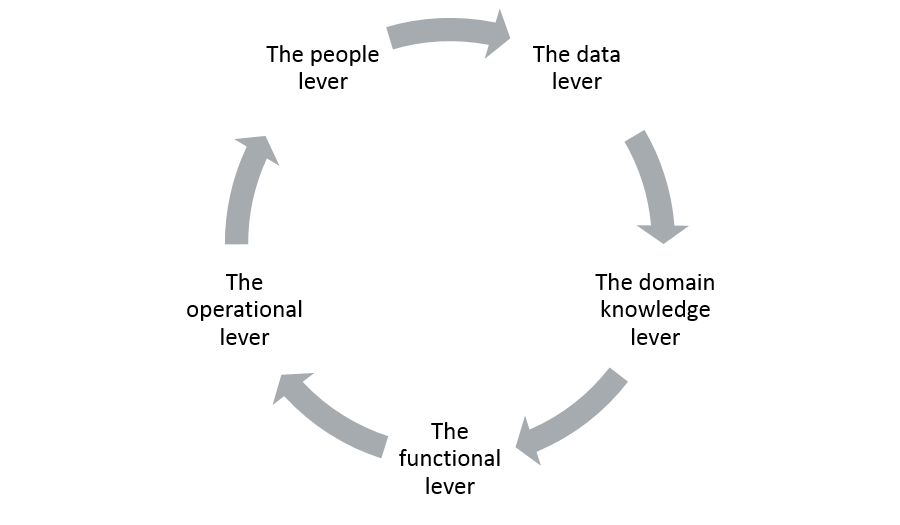

This example reveals the five AI transformation levers BFSI leaders must adopt to succeed

This example of a successful transformation partnership contains the core building blocks that demonstrate the five transformation levers executives must focus on to evolve their business and be competitive in the modern market. These levers are an evolution of the traditional focus on “people, process, technology” theme that has helped drive business change in the past.

Source: HFS Research, 2020

- The data lever: Financial services is heavily dependent on both the quality and quantity of data. A major chunk of AI is fundamentally data science, especially ML, predictive analytics, forecasting, and business analytics. Hence the data lever of financial services finds the maximum and relevant usage of AI and ML techniques.

- The domain knowledge lever: The financial services domain is strictly governed by business rules that are deeply entrenched in the knowledge of the financial industry and ubiquitous—present in banking, capital markets, insurance, property-related services, and elsewhere. Systems can best present and process business rule knowledge with techniques like natural language processing (NLP) and rule-based expert systems from AI.

- The functional lever: Financial services are also heavily function-based, and the functions include both transaction processing and analytics and include tasks such as accounts receivable processing, payables processing, transaction completion, debt settlement, reconciliation, and so on. All these functions require in-depth procedural knowledge, which can be codified and facilitated by various AI techniques to manage, code, represent, and process unstructured knowledge.

- The operational lever: Operations require smooth transition and completion of work among people and teams through efficient and effective knowledge sharing, which is an area that NLP techniques like conversational AI can facilitate.

- The people lever: The last and the most crucial lever in financial services is people. The financial services industry requires a direct exchange of value and negotiations between various stakeholders. The functional and domain knowledge levers are also directly and heavily reflective of the strengths of the people lever in any financial services or fin-tech provider organizations.

The Bottom Line: The BFSI sector is facing unrivaled disruption and a new competitive landscape. Smart incumbents will rethink their approach to transformation to ensure they survive until tomorrow.

The reality for the modern BFSI executives is that their competitive landscape is rapidly changing. Digital natives are out-accelerating them with innovative technology stacks, incumbents are rebuilding business models, and the tech giants are spending their way through traditional barriers to entry. Complacency simply isn’t an option. In this report, we examined how one enterprise is shifting beyond a “wait and see” approach to take steps to transform legacy and antiquated systems and processes by adopting the innovative AI-focused technology of its partner, Xceptor. Other enterprises that hope to outlast the latest wave of disruption must take similar steps to survive.

Explore our technology solutions

Reconciliations

Helping financial institutions to automate simple to complex reconciliations end-to-end, providing greater data transparency, accuracy, and control.

Client Onboarding

Boost your ROI, guarantee compliance and minimize risks: discover how our platform can transform your client management and transaction workflow processes.

Capital Markets Operations

Our capital markets operations product supports automation and modernization of your post-trade operational processes.

Tax Processing

Our tax processing product enables end-to-end, automated, operational withholding tax processing capabilities.

Reconciliations

Helping financial institutions to automate simple to complex reconciliations end-to-end, providing greater data transparency, accuracy, and control.

Client Onboarding

Boost your ROI, guarantee compliance and minimize risks: discover how our platform can transform your client management and transaction workflow processes.

Capital Markets Operations

Our capital markets operations product supports automation and modernization of your post-trade operational processes.

Tax Processing

Our tax processing product enables end-to-end, automated, operational withholding tax processing capabilities.

Reconciliations

Helping financial institutions to automate simple to complex reconciliations end-to-end, providing greater data transparency, accuracy, and control.

Client Onboarding

Boost your ROI, guarantee compliance and minimize risks: discover how our platform can transform your client management and transaction workflow processes.

Get in touch

Latest insights and resources

Get our expert insights and resources to learn more about automating asset management processes, data management and how we’re supporting financial services transformation.

Discover how capital markets firms are transforming operational efficiency with process automation. Learn from industry experts and Xceptor clients about the...

Prepare for the UK's T+1 settlement transition by embracing automation now to ensure compliance and operational efficiency by the 2027 deadline.